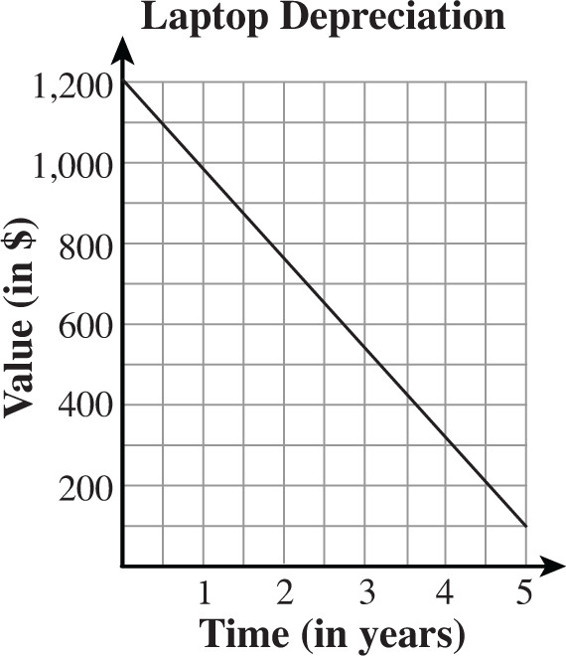

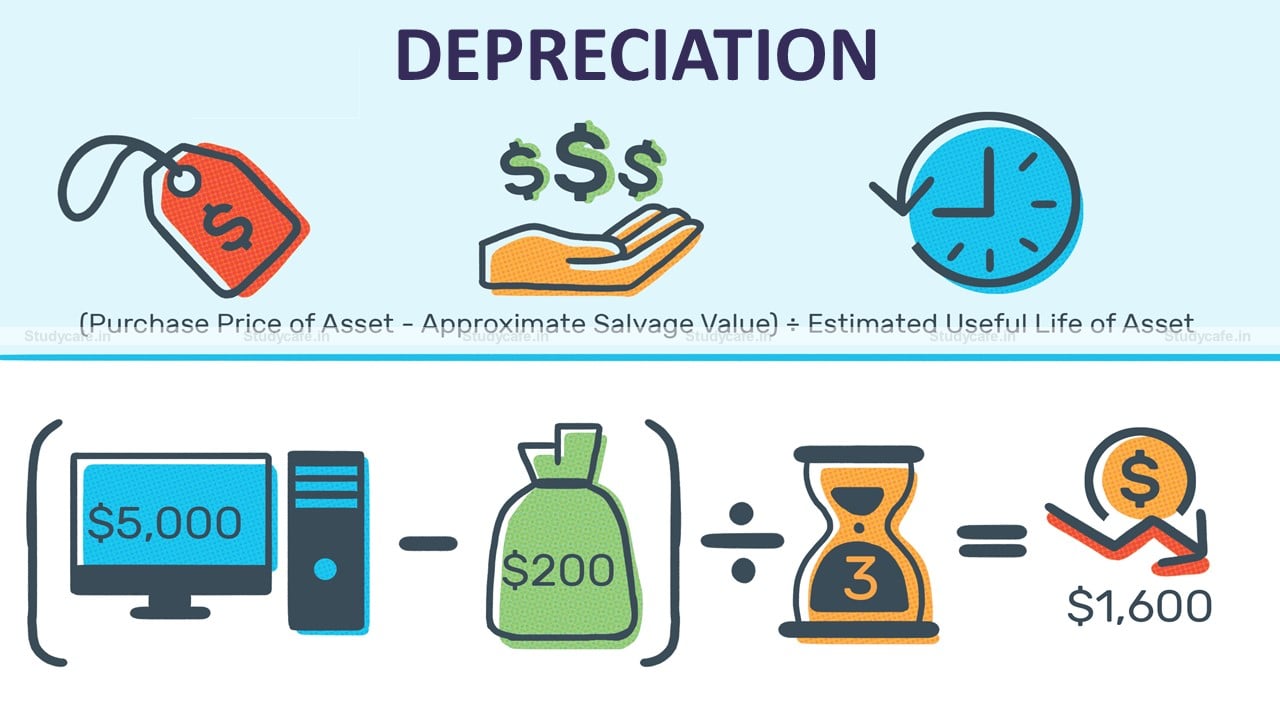

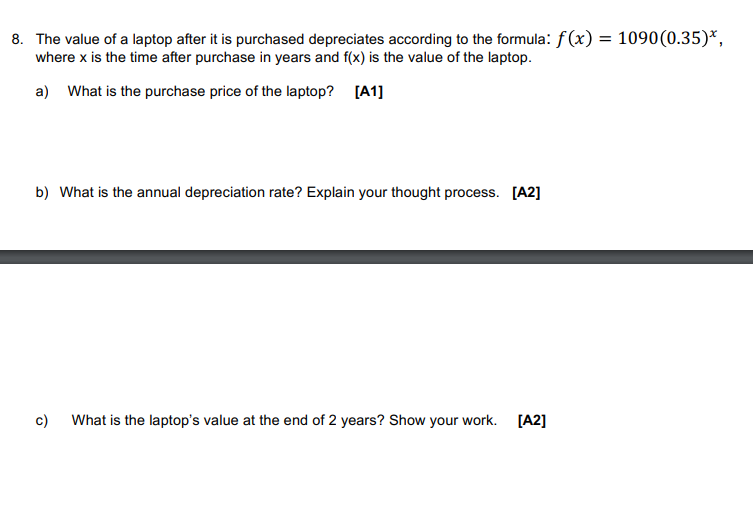

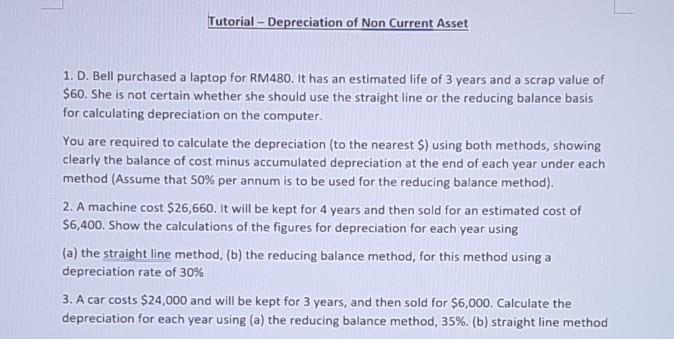

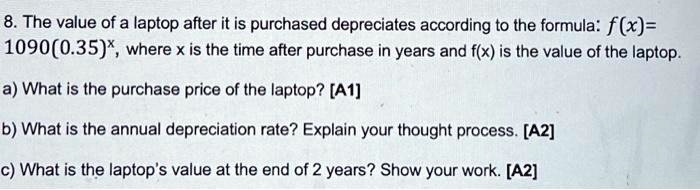

SOLVED: 8. The value of a laptop after it is purchased depreciates according to the formula: f (x)= 1090(0.35)*, where x is the time after purchase in years and f(x) is the

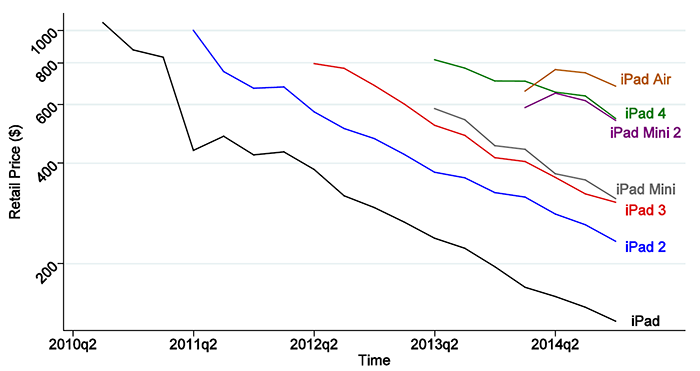

SOLVED: College Mathematics 5 points Rhonda bought a new laptop for 800. The laptop depreciates, or loses, 20% of its value each year. The value of the laptop at a later time

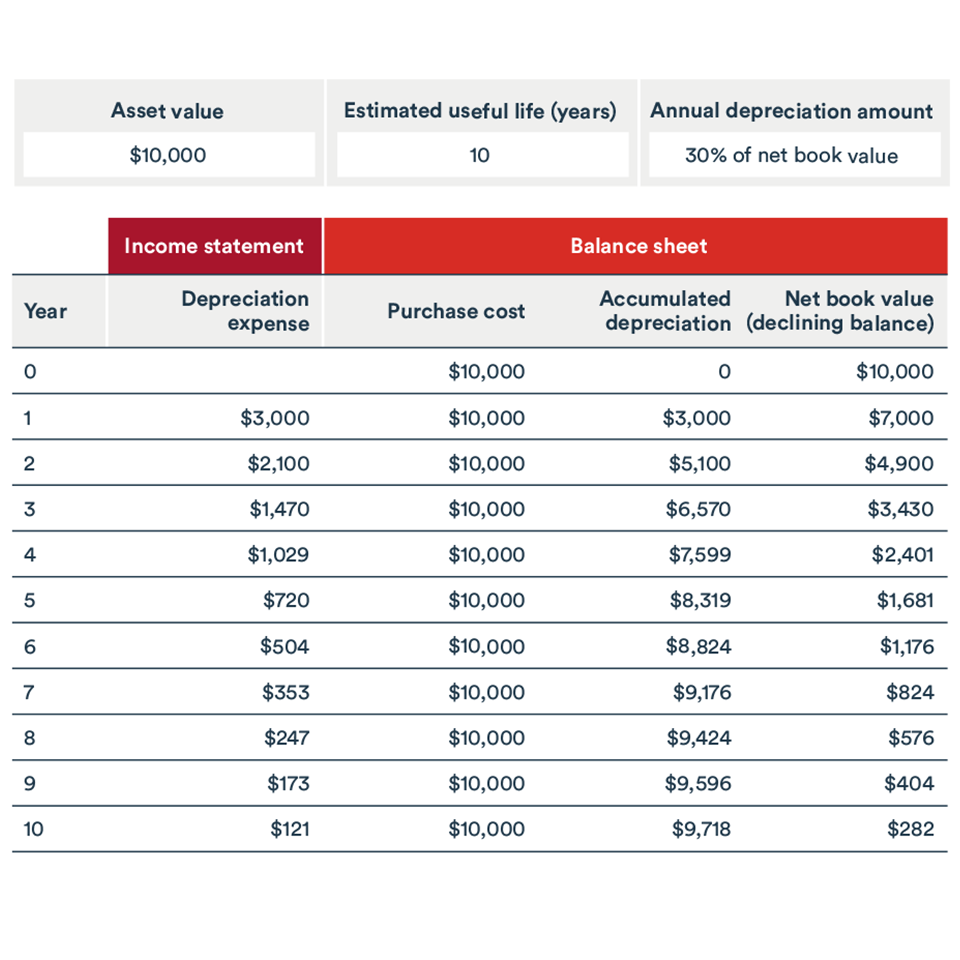

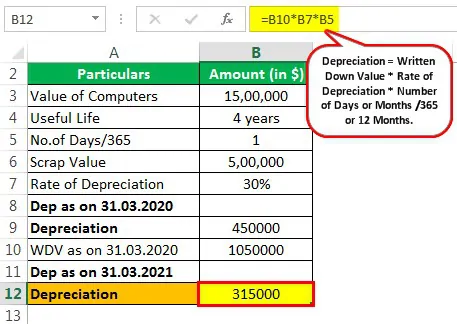

Double Declining Balance (Method of Depreciation) | Double Declining Balance | By IGCSE Accounting Private | Hey there Welcome back to accounting stuff I'm James and in this video, I'll show you